USI business students offer free income tax help

January 13, 2015

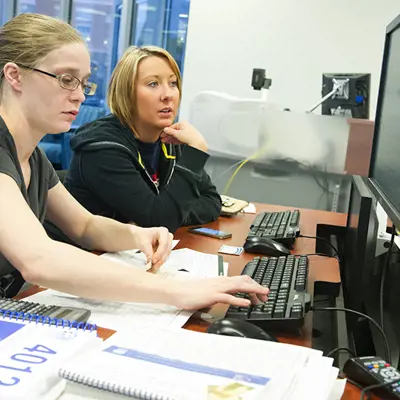

Through the Volunteer Income Tax Assistance Program (VITA), University of Southern Indiana students in the Romain College of Business will provide free federal and state income tax preparation on Wednesdays, February 4-April 8.

"We have seven students enrolled in the program this year, allowing us to help approximately 12 taxpayers per night this tax season," said Dr. Brett Long, associate professor of accounting and business law. "Preparing tax returns for members of our community is a great experience for our accounting students and a real savings for taxpayers."

In VITA programs, the Internal Revenue Service partners with national and local organizations to provide tax services to individuals with low-to-moderate income at no cost to the taxpayer. Accounting students will interview and prepare the taxes of those taxpayers who make an appointment for the service. VITA sites do not prepare Schedule C business forms or Schedule E rental forms. Federal and state tax returns are prepared at the time of the appointment, and all taxpayers must be available to sign their returns. Preparation of returns typically takes 90 minutes to two hours to complete.

The sessions will be held by appointment only in Room 1004 in the Business and Engineering Center on the following Wednesdays: February 4, 11, 18 and 25; March 4, 18 and 25; and April 1 and 8. Appointments will be available at 5 p.m. and 6:45 p.m. The USI VITA site is closed March 11 for Spring Recess.

Individuals are required to bring their tax information, photo identification cards and Social Security cards for themselves and any dependents. International students must bring their passports and visas as well. The IRS encourages electronic filing and returns will be filed electronically for those who are eligible.

Please bring copies of your 2013 state and federal tax returns if they are available. Your tax returns from the prior year are very helpful in preparing correct and complete current year returns. Paper returns will be prepared for those taxpayers who do not qualify for electronic filing or prefer paper returns.

To make an appointment, call the Romain College of Business at 812-464-1718.